All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance coverage right up to line of it becoming a Modified Endowment Agreement (MEC). When you make use of a PUAR, you quickly raise your cash worth (and your survivor benefit), thus enhancing the power of your "bank". Better, the more cash money worth you have, the better your interest and dividend repayments from your insurer will certainly be.

With the increase of TikTok as an information-sharing platform, economic recommendations and methods have actually located a novel method of spreading. One such method that has actually been making the rounds is the limitless financial idea, or IBC for short, garnering recommendations from stars like rapper Waka Flocka Flame. However, while the approach is presently prominent, its roots trace back to the 1980s when financial expert Nelson Nash presented it to the globe.

Generational Wealth With Infinite Banking

Within these plans, the cash worth expands based upon a price set by the insurance firm (Infinite Banking). Once a significant cash money worth collects, policyholders can acquire a cash money worth loan. These financings vary from conventional ones, with life insurance acting as collateral, meaning one can shed their protection if borrowing excessively without ample cash money value to sustain the insurance costs

And while the attraction of these plans appears, there are innate limitations and threats, necessitating persistent cash money worth tracking. The approach's legitimacy isn't black and white. For high-net-worth individuals or entrepreneur, particularly those making use of strategies like company-owned life insurance (COLI), the advantages of tax obligation breaks and compound growth could be appealing.

The appeal of unlimited financial doesn't negate its obstacles: Price: The foundational demand, a permanent life insurance policy policy, is pricier than its term counterparts. Eligibility: Not everybody gets entire life insurance because of extensive underwriting processes that can exclude those with details health or way of living problems. Complexity and threat: The detailed nature of IBC, coupled with its risks, may hinder several, particularly when easier and less risky options are offered.

What makes Infinite Banking different from other wealth strategies?

Allocating around 10% of your monthly earnings to the plan is simply not feasible for a lot of individuals. Part of what you read below is simply a reiteration of what has currently been stated over.

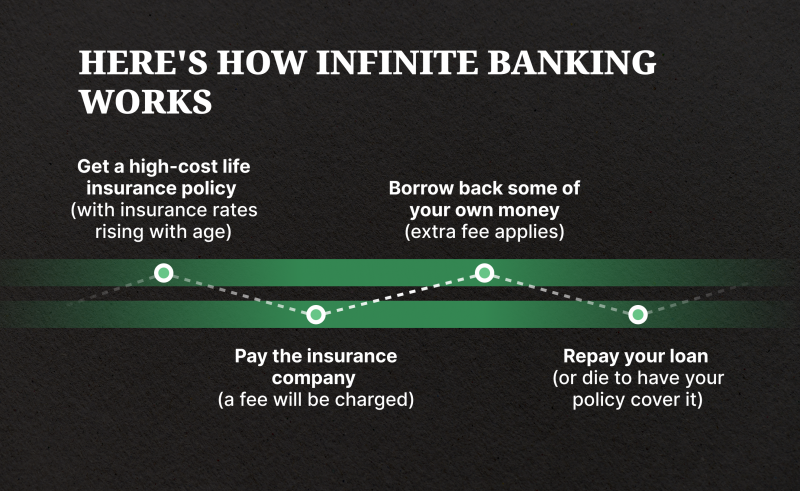

Prior to you obtain on your own into a circumstance you're not prepared for, know the following first: Although the idea is generally marketed as such, you're not really taking a loan from on your own. If that were the case, you wouldn't have to repay it. Rather, you're borrowing from the insurance provider and have to repay it with interest.

Some social media articles suggest utilizing cash money worth from whole life insurance to pay down credit scores card debt. When you pay back the financing, a section of that passion goes to the insurance firm.

Setting up an Infinite Banking system requires proper financial structuring.

A well-designed policy provides tax advantages that support wealth accumulation.

Unlike traditional loans, Infinite Banking eliminates the need for credit checks. Speak with an Infinite Banking consultant today to develop a custom Infinite Banking system.

For the initial a number of years, you'll be repaying the compensation. This makes it exceptionally challenging for your plan to accumulate value throughout this time around. Entire life insurance coverage prices 5 to 15 times a lot more than term insurance. Most people merely can not afford it. So, unless you can manage to pay a couple of to a number of hundred dollars for the following years or more, IBC won't work for you.

What are the common mistakes people make with Policy Loan Strategy?

Not every person ought to count only on themselves for financial safety and security. If you need life insurance coverage, below are some important suggestions to take into consideration: Take into consideration term life insurance policy. These plans offer protection throughout years with considerable monetary obligations, like home loans, trainee finances, or when taking care of little ones. Make certain to look around for the very best rate.

Imagine never ever having to worry regarding bank loans or high interest rates once more. That's the power of boundless financial life insurance.

There's no set loan term, and you have the liberty to pick the settlement schedule, which can be as leisurely as paying off the loan at the time of fatality. Life insurance loans. This versatility includes the maintenance of the loans, where you can select interest-only payments, keeping the funding equilibrium level and convenient

Holding money in an IUL repaired account being attributed passion can often be better than holding the cash money on deposit at a bank.: You've constantly fantasized of opening your own bakeshop. You can borrow from your IUL policy to cover the initial costs of leasing a space, purchasing devices, and employing team.

How can Infinite Banking Benefits reduce my reliance on banks?

Individual fundings can be acquired from traditional financial institutions and credit unions. Borrowing money on a credit scores card is generally really pricey with annual percent prices of interest (APR) typically getting to 20% to 30% or more a year.

Latest Posts

R Nelson Nash Infinite Banking Concept

Infinite Banking Concept Example

How To Be Your Own Bank In Crypto