All Categories

Featured

Table of Contents

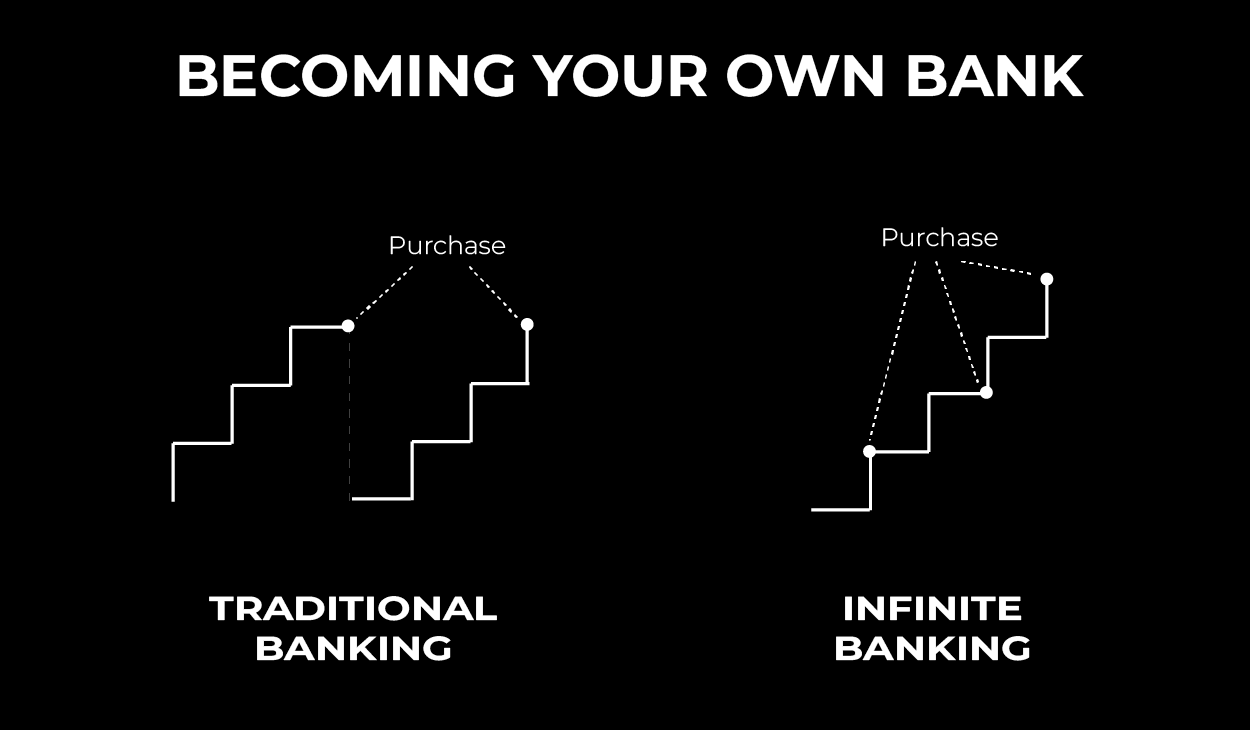

We utilize data-driven techniques to evaluate monetary items and solutions - our evaluations and rankings are not affected by advertisers. Unlimited banking has actually caught the interest of numerous in the personal financing world, assuring a course to monetary freedom and control.

Boundless banking refers to a monetary approach where a private becomes their own banker. The policyholder can borrow against this money worth for numerous economic demands, successfully lending money to themselves and paying back the plan on their own terms.

This overfunding increases the development of the plan's money value. Limitless financial uses several benefits.

What is the best way to integrate Private Banking Strategies into my retirement strategy?

Below are the response to some questions you might have. Is limitless banking legitimate? Yes, unlimited financial is a genuine approach. It involves utilizing a whole life insurance policy policy to create an individual financing system. Nonetheless, its efficiency relies on different factors, including the plan's structure, the insurer's performance and just how well the technique is taken care of.

How much time does limitless financial take? Boundless banking is a long-lasting strategy. It can take a number of years, commonly 5-10 years or more, for the cash money worth of the policy to grow adequately to begin obtaining versus it efficiently. This timeline can vary depending upon the policy's terms, the costs paid and the insurer's performance.

Is Infinite Banking For Retirement a better option than saving accounts?

So long as costs are current, the insurance holder just calls the insurance provider and demands a car loan versus their equity. The insurer on the phone will not ask what the finance will be utilized for, what the earnings of the consumer (i.e. insurance holder) is, what other assets the person might have to function as security, or in what timeframe the individual plans to pay back the financing.

In comparison to describe life insurance policy products, which cover only the recipients of the policyholder in the occasion of their fatality, entire life insurance coverage covers a person's entire life. When structured effectively, whole life policies create a special income stream that increases the equity in the policy over time. For additional reading on exactly how this jobs (and on the pros and disadvantages of whole life vs.

In today's world, globe driven by convenience of comfort, usage many take several granted our nation's country founding principlesBeginning concepts and flexibility.

Infinite Banking Wealth Strategy

Reduced financing passion over plan than the traditional finance items obtain collateral from the wholesale insurance plan's cash money or surrender worth. It is a concept that allows the insurance policy holder to take financings on the whole life insurance policy policy. It ought to be available when there is a minute economic concern on the person, where such loans might help them cover the economic tons.

Such abandonment worth serves as cash money security for a loan. The insurance policy holder requires to link with the insurance provider to ask for a finance on the policy. A Whole Life insurance policy policy can be labelled the insurance product that offers defense or covers the person's life. In the event of the feasible fatality of the person, it offers economic safety to their relative.

It starts when an individual takes up a Whole Life insurance plan. Such policies maintain their values due to the fact that of their conservative strategy, and such policies never spend in market instruments. Boundless banking is a concept that allows the policyholder to take up finances on the whole life insurance coverage policy.

What is the best way to integrate Wealth Building With Infinite Banking into my retirement strategy?

The cash or the surrender value of the entire life insurance serves as security whenever taken car loans. Expect a specific enrolls for a Whole Life insurance coverage plan with a premium-paying term of 7 years and a plan period of two decades. The specific took the plan when he was 34 years of ages.

The collateral acquires from the wholesale insurance coverage policy's cash or abandonment worth. These elements on either extreme of the range of facts are reviewed listed below: Limitless banking as a financial development boosts cash flow or the liquidity profile of the insurance holder.

Borrowing Against Cash Value

The insurance plan financing can additionally be readily available when the individual is out of work or encountering health and wellness issues. The Whole Life insurance coverage policy preserves its overall value, and its efficiency does not connect with market efficiency.

In addition, one must take just such plans when one is financially well off and can take care of the plans costs. Unlimited financial is not a scam, yet it is the ideal thing the majority of people can decide for to enhance their financial lives.

Infinite Banking For Financial Freedom

When individuals have infinite banking described to them for the very first time it appears like a wonderful and risk-free method to expand riches - Privatized banking system. The concept of changing the hated bank with loaning from yourself makes so much even more feeling. However it does need changing the "hated" financial institution for the "despised" insurer.

Of program insurance policy companies and their agents like the idea. They invented the sales pitch to offer more entire life insurance policy.

There are 2 significant monetary catastrophes built into the boundless banking idea. I will certainly reveal these imperfections as we function through the math of just how unlimited financial actually functions and exactly how you can do a lot far better.

Latest Posts

R Nelson Nash Infinite Banking Concept

Infinite Banking Concept Example

How To Be Your Own Bank In Crypto